Blog

read our latest posts

Our Blog

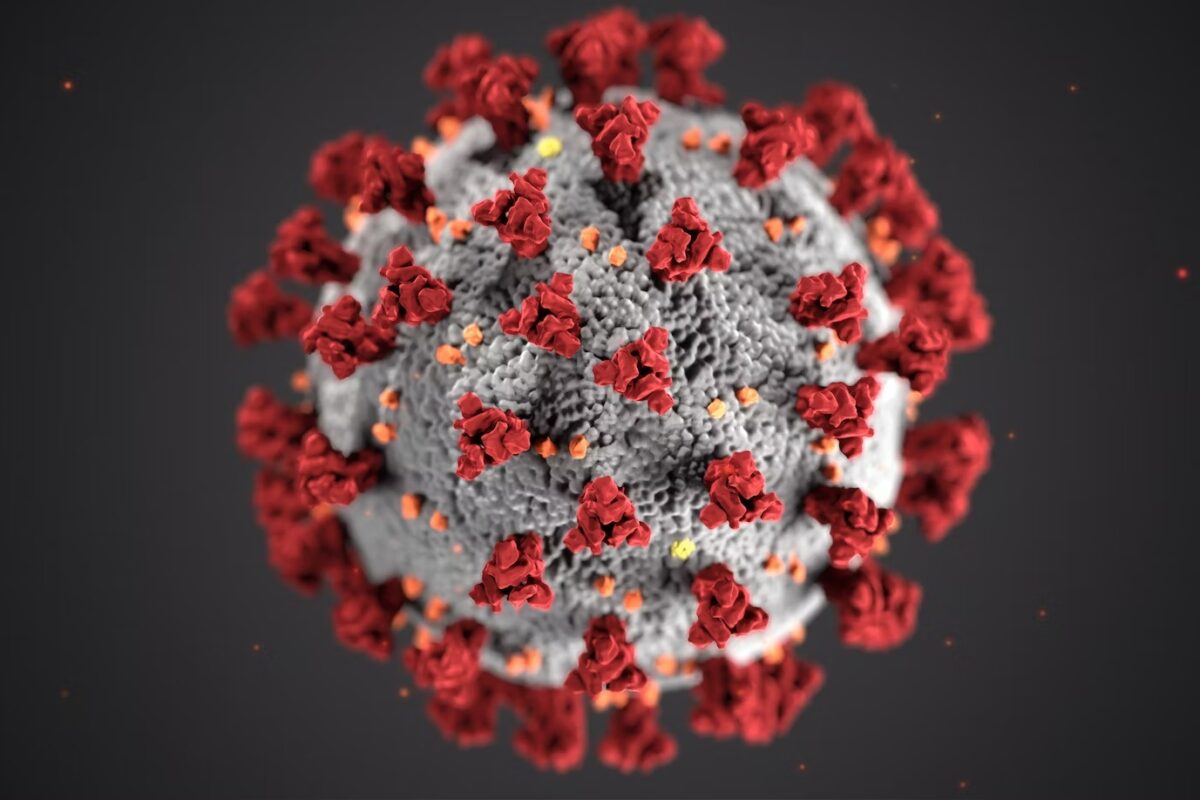

EFG's role in the fight against COVID-19

COVID-19 has altered the way the world has lived over the last few months. While we…

Why Financing Injection Molding Equipment is Important and How Small Businesses Can Benefit

When it comes to buying injection molding equipment, there are a lot of important things that…

Stay Updated With The Latest Technology; Improve Productivity & Cut Down Upfront Costs With Equipment Financing Solutions

Every company aspires to have the best state-of-the-art technology to be able to provide quality products…

EFG the Equipment Financing Partner You Need

When it comes to equipment financing, EFG is your solution. We can offer you financing options…

COVID-19 Impacting 2020 Trade Shows, Don’t Let that Keep you from Networking

Equipment Finance Group, like many other vendors, distributors, and businesses, we had planned to attend trade…

Six Equipment Financing Questions You Should Ask, that EFG Can Answer

When it comes to equipment financing, Equipment Finance Group provides superior financing solutions for you by…